2025 Intel (INTC) Stock Analysis & AI Outlook: Foundry, AI, ETF & Institutional Holdings

📌 Beyond the Hype: Is AMD Really the Next NVIDIA – Or Just a Transitional Play?

🧾 Author’s Perspective

NVIDIA is testing all-time highs again—too late to get in?

So who’s next in the AI hardware race? Some say “NVIDIA’s peaked, time to buy AMD.”

But whenever tech progress hits a ceiling, fast-moving followers with value pricing can shake up the market.

Is this AMD’s big moment, or is NVIDIA’s dominance only getting stronger?

Now’s the time to break it down.

📌 Executive Summary

AMD is in the spotlight as a latecomer to the GPU/AI chip game. Yet global tech giants are moving away from price wars—opting instead for custom AI chip development. This piece breaks down AMD’s strengths and weaknesses, and what’s really happening in the field.

🔍 1️⃣ Why AMD Is Gaining Traction

🧩 To simplify:

📉 2️⃣ AMD's Drawbacks and Weaknesses

🧭 3️⃣ The Market Is Betting on In-House Chips, Not Just AMD

Many investors look at AMD as a cheaper NVIDIA, but global tech titans are charting a different path.

Instead of just switching vendors, they’re designing their own AI chips to escape dependence.

This trend suggests custom ecosystem building, not simply slotting in AMD, is the deeper play.

📦 Companies Leading the Shift

| Company | Custom Chip | Strategy |

|---|---|---|

| TPU (Tensor Processing Unit) | Launched up to v5; in-house & partially public | |

| Amazon (AWS) | Trainium, Inferentia | Used for cost-effective AI inference |

| Meta (Facebook) | MTIA | AI training chip; independence from suppliers |

| Microsoft | Azure Maia 100 | Adopted for some OpenAI server workloads |

| OpenAI | Exploring custom chips | Seeking independence from NVIDIA |

| Alibaba, Huawei, Tencent | T-Head, Ascend, etc. | Building unique AI stacks for geopolitical reasons |

| Tesla | D1 chip (Dojo) | Self-driving focus, less reliant on GPUs |

So the real market trend isn’t AMD replacing NVIDIA, but each giant racing to own a self-sufficient AI stack.

💡 AI Semiconductor Is No Longer a Simple Comparison

In the past, chip wars were about raw speed. Now, it’s about who can build the right ecosystem.

AMD’s cost advantage and similar specs to H100 aren’t enough to unseat NVIDIA.

Big Tech is making custom silicon to match their models, workflows, and APIs—targeting performance, cost, and compatibility all at once.

The real battle is shifting from “NVIDIA vs AMD” to “NVIDIA vs Custom Silicon + Ecosystem Self-Reliance.”

📊 Stock Price Charts (TradingView)

|

| Daily Chart |

|

| Monthly Chart |

|

| Yearly Chart |

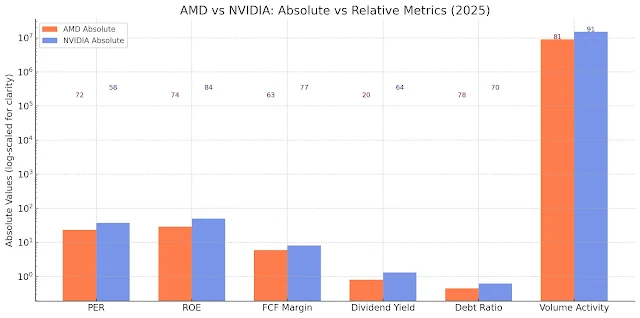

📊 AMD vs NVIDIA: 6 Key Metrics (May 2025)

| Metric | Description | AMD Score | NVIDIA Score |

|---|---|---|---|

| PER | Lower = More undervalued | 72 | 58 |

| ROE | Higher = More efficient | 74 | 84 |

| FCF Margin | Cash flow generation | 63 | 77 |

| Dividend Yield | Payout stability | 20 | 64 |

| Debt Ratio | Financial soundness | 78 | 70 |

| Volume Change | Technical momentum | 81 | 91 |

Overall Scores:

📈 Radar Chart Score

|

| Compares major metrics as 100-point normalized scores. Data from Investing.com and Yahoo Finance. |

|

| Visualizes both actual numbers and 100-point normalized scores. |

👤 Leadership Insight: Can Lisa Su Lead AMD to the Top?

📈 Analyst Price Targets (as of May 2025)

| Firm | Target Price | Recommendation |

|---|---|---|

| Morgan Stanley | $205 | Overweight |

| Goldman Sachs | $198 | Neutral |

| Citi | $190 | Hold |

| Bank of America | $210 | Buy |

📊 Financial & Investment Score Summary (ChatGPT Assessment)

ChatGPT assessment: AMD is structurally sound and shows solid growth potential, but still lags top peers in software ecosystem and innovation.

📝 Implication: AMD is more than just a follower. Integrated CPU-GPU design and cost advantages are reshaping corporate IT choices. But the long-term winner in AI may not be the firm that catches NVIDIA—but the one that escapes its ecosystem entirely.

🎯 Key Takeaways

This article is an analysis, not investment advice.

The analysis is based on ChatGPT, TradingView, Investing.com, and Yahoo Finance data, not professional advice.

All investment decisions are solely the reader’s responsibility; use this content for informational purposes only.

댓글

댓글 쓰기